The Student Debt Crisis in 2021: Everything You Need to Know

Expert Contributor

Student debt is undoubtedly one of the biggest economic dilemmas of our generation, and there's still no sign of it slowing down. With growth rates that are than the U.S. economy, it's no wonder our country has 43 million borrowers that owe over $1.7 trillion. And although the student debt crisis is much more widely discussed than it used to be, it's been a problem for a long time— as in, the last 30 – 40 years. Whether you're preparing to go back to school, or one of the 43 million graduates wondering how we got into this mess— stick with us. We've got the full scoop on student debt right here.

A History of Student Debt

Most experts tie the start of the student debt crisis to the years between the mid eighties and early nineties when college degrees became the norm for many young working professionals. During that time, the cost of attending college also began to rise astronomically.

According to the October 2020 report on student debt conducted by

The Economic Impact of Student Debt

The economic impact of student debt is one of those things that's hard to put a number to, but its effects can be felt nonetheless— especially in the number of young professionals who struggle to afford housing, or don't have the income to start saving for retirement.

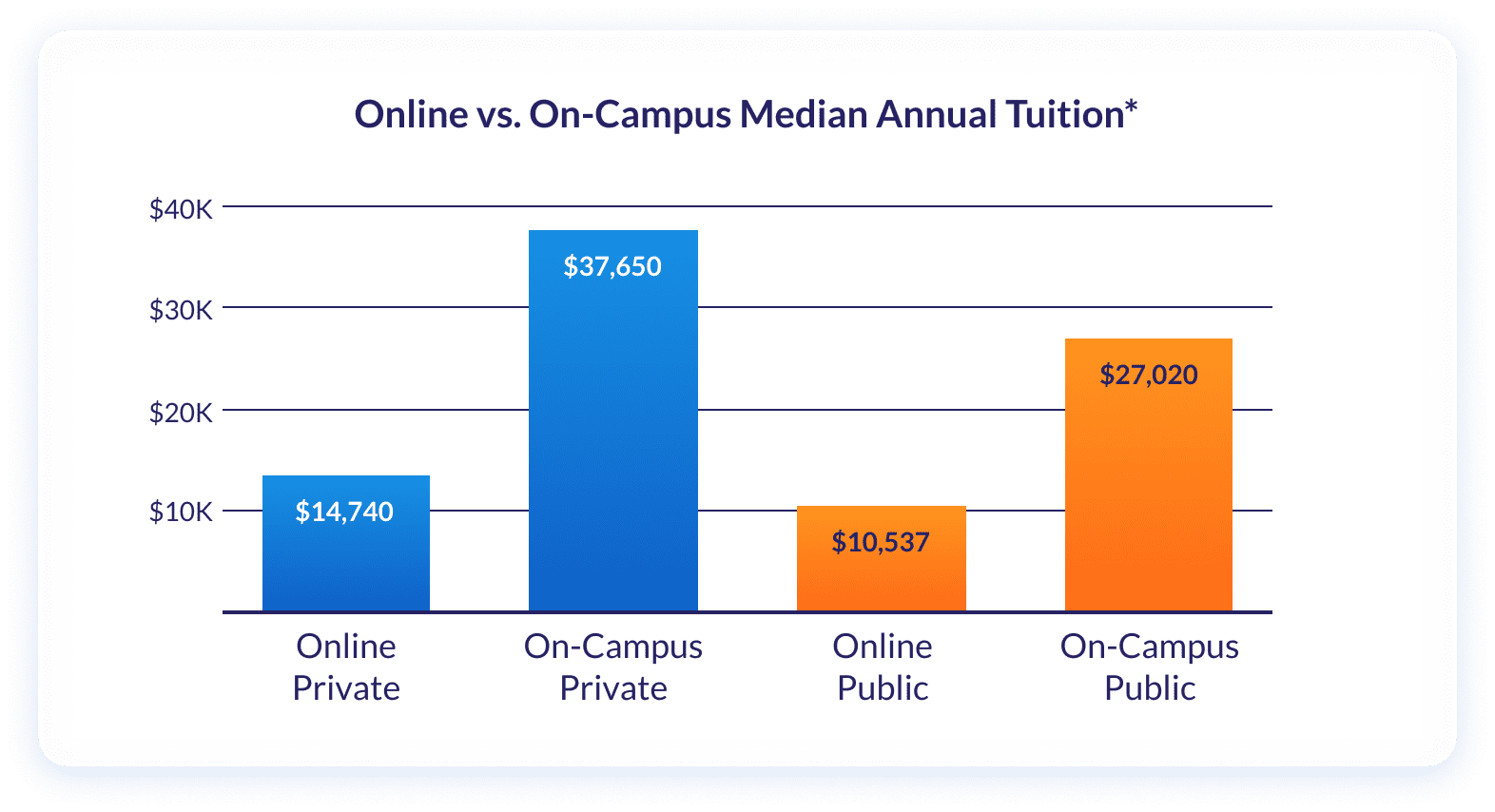

"Graduates have had to put their lives on hold," says Matthew Carpenter, CEO and Founder of in recent years with the expansion of online programs. By studying online, you'll not only limit your living expenses (and avoid paying for on-campus room and board) but you'll also cut down on any commuting time and costs associated with studying in-person. The tuition itself is also much more affordable for students who choose to study online rather than in-person. Take a look at the breakdown: